Billions in Reserves, Pennies in Rebates: How Blue Cross NC Dodged Its Duty to Give Back

People are busy fighting each other while the insurance companies skate by unscathed. Let’s talk about the one that dominates North…

By Matt Stone

A deep dive into how North Carolina’s largest “nonprofit” insurer, with billions in reserves and million-dollar executive pay, keeps raising premiums while claiming slim margins.

People are busy fighting each other while the insurance companies skate by unscathed. Let’s talk about the one that dominates North Carolina. One that is supposedly “nonprofit.”

Before the Affordable Care Act (ACA), insurers had far more levers to pull for profit. They could charge higher premiums based on age, gender, or the possibility of pregnancy, and they could outright deny coverage to anyone with a preexisting condition: a strategy that kept their costs low and margins high.

The ACA changed that. It required insurers to spend at least 80 percent of premium revenue directly on medical care, a rule known as the medical loss ratio, leaving only 20 percent for administration, marketing, and executive pay. For a while, that limit squeezed insurance profits.

But the industry adapted quickly. Within a few years, insurers learned how to stretch the definition of “medical care,” counting things like 24-hour nurse hotlines, certain marketing expenses, and customer service programs as health-related spending.

Blue Cross NC lost money in 2014 and 2015, but has turned a profit every year since, even through the pandemic. Over the past decade, it built up such large reserves that it was forced to issue rebates to policyholders when it exceeded the ACA’s cap.

Now, with its push to create a new holding company, Blue Cross NC could shift those excess reserves out of the regulated insurance entity, effectively sidestepping the ACA’s rebate requirements and keeping more cash in-house, according to health policy expert Steve Obusek.

There are no shareholders. Blue Cross Blue Shield of North Carolina (BCBSNC) is a not-for-profit that retains surplus as reserves built from member premiums.

According to BCBSNC’s own 2022 reporting, the company posted about $36 million in net income on $10.9 billion in revenue, roughly a 0.3% margin, while total capital and surplus exceeded $4 billion.

If the margin is only 0.3%, how did reserves grow by hundreds of millions, and why are premiums still going up?

According to Blue Cross NC’s own reporting for 2022, the company posted about $36 million in net income on $10.9 billion in revenue, roughly a 0.3% margin, while total reserves exceeded $4 billion. If the margin is only 0.3%, how did reserves grow by hundreds of millions, and why are premiums still going up?

Recent filings show the CEO’s compensation exceeded $4 million in 2021 (including bonuses). If 2022 pay was similar, that’s a double-digit share of annual profit; a striking figure for a “nonprofit” facing record premiums.

In April 2023, North Carolina State Treasurer Dale Folwell warned lawmakers that a restructuring proposal, House Bill 346 / Senate Bill 296, would “cement Blue Cross NC’s monopoly” by giving the insurer more control over the state’s health market while reducing transparency and accountability to the public.

What the filings show (2023 Blue Cross NC Foundation Form 990-PF)

Blue Cross Blue Shield of North Carolina isn’t just the state’s largest insurer,it’s one of its most powerful institutions. According to North Carolina Health News, the company controls roughly 83 percent of the individual insurance market and nearly 80 percent of the group health market. That kind of market share gives Blue Cross a level of dominance few “nonprofits” could ever dream of. It insures more than 2.3 million North Carolinians directly, with millions more covered through employer-sponsored, Medicaid, and Medicare contracts. (Rose Hoban and The Charlotte Ledger, “What Is Blue Cross Blue Shield NC Up To?,” North Carolina Health News (April 24, 2023))

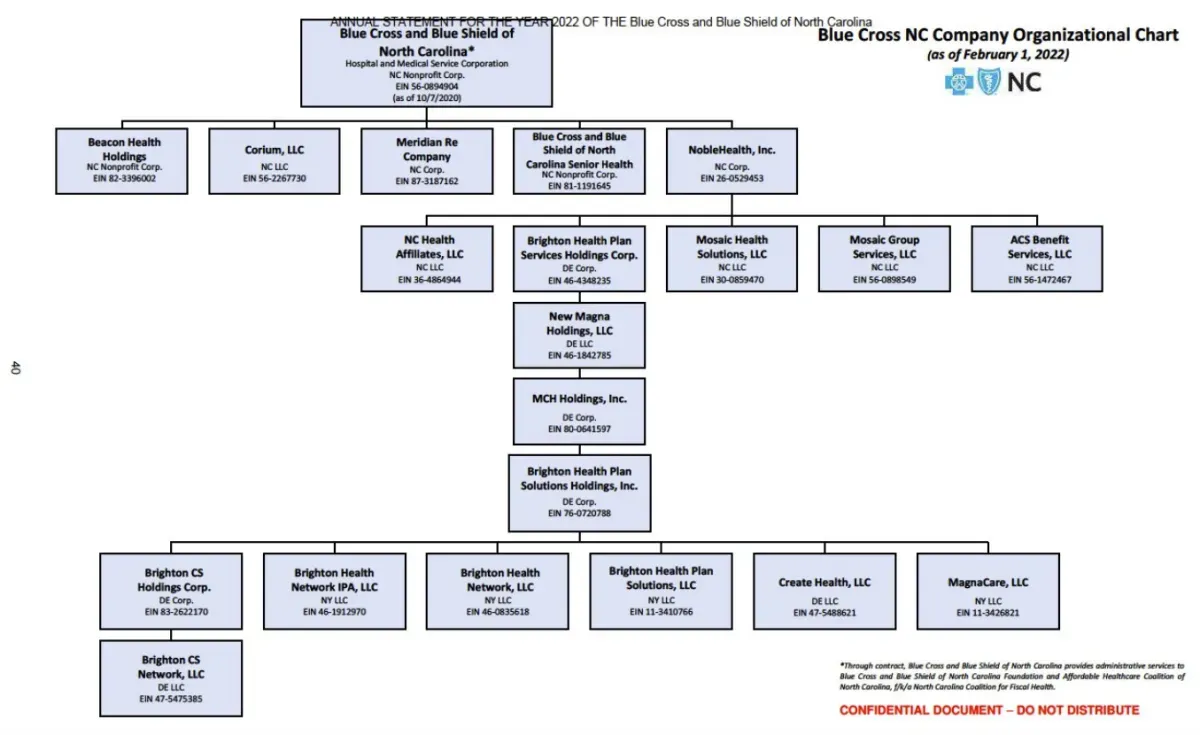

Blue Cross NC is a nonprofit in name, but its 2022 organizational chart tells a different story. Beneath the parent company sit more than a dozen subsidiaries—many registered in Delaware, a state known for secrecy and tax advantages. These include Mosaic Health Solutions and Brighton Health Plan Holdings, which manage for-profit ventures and joint investments. That structure allows Blue Cross to move money out of public view, earn profits through side companies, and keep those gains off the nonprofit’s books. It’s a legal maze that makes “transparency” more of a slogan than a standard.

The nonprofit makes money from the for-profit subsidiaries underneath its umbrella—companies it owns, funds, or partially controls through a web of LLCs. It’s a structure that lets Blue Cross NC profit like a private corporation while maintaining the public image and tax benefits of a nonprofit.

As of 2023, Blue Cross NC reported $7.7 billion in total assets, including about $4.5 billion in reserves: funds meant to ensure stability during downturns. But when the insurer is sitting on billions while premiums keep rising, it raises an obvious question: stability for whom?

The Restructuring Bill and the Monopoly Warning

In 2023, the North Carolina General Assembly introduced House Bill 346 / Senate Bill 296, a proposal that would allow Blue Cross NC to form a nonprofit holding company with the power to create for-profit subsidiaries. The company pitched it as modernization, a way to compete with national giants like UnitedHealth and Aetna. But critics saw something else: a potential erosion of oversight.

State Insurance Commissioner Mike Causey called the bill “missing many provisions … necessary to protect the people, the policyholders,” warning it could lead to higher premiums and reduced transparency. Meanwhile, State Treasurer Dale Folwell went further, warning that the bill would “cement Blue Cross NC’s monopoly” and give the company even greater control over the state’s healthcare market while weakening accountability to the public.

Money, Power, and Influence

Blue Cross NC’s reach extends well beyond the insurance market. North Carolina Health News reports that the company employed 11 lobbyists in the past year, spending more than $550,000 on lobbying contracts and contributing about $277,000 in campaign donations through its political action committee in 2022.

That’s not the behavior of a struggling nonprofit, it’s the profile of a politically immoral powerhouse. While families across the state juggle rising premiums, Blue Cross invests heavily in shaping the laws that govern it.

The Larger Trend

The push to form a holding company mirrors a national trend of vertical integration, where insurers buy physician groups, clinics, and other care providers to tighten their grip on the healthcare pipeline. The article calls this “the new arms race in health care.” What it means for North Carolinians is simple: the more the insurer controls, the fewer choices patients have, and the harder it becomes to hold anyone accountable.

1 Revenue vs. expenses mismatchThe Foundation reported $6.75 million in revenue but $28.65 million in expenses — spending roughly 4.2 times what it brought in. That means a large draw from prior-year reserves.

2 Massive asset baseYear-end assets totaled $209.1 million, nearly 31 times annual revenue. For a nonprofit, that’s a sizable cushion built from member premiums that deserves scrutiny.

3 Tiny officer compensation listedThe filing shows only $10,000 in “compensation of officers.” That number is so low it almost certainly reflects pay routed through Blue Cross NC or shared-services agreements, obscuring where executive compensation actually sits.

4 Negative net-asset change isn’t the whole storyThe Foundation shows a – $21.9 million change in net assets for 2023. That isn’t necessarily mismanagement, foundations can legally spend from reserves, but it raises the larger question: when and how did they build such enormous reserves in the first place?

The questions Blue Cross NC must answer for:

Where did the money go?

If you’re a nonprofit with a 0.3% margin, show the math that reconciles executive pay, growing reserves, and rising premiums.

I’ve formally requested supporting documents and copied the North Carolina Department of Insurance, the Attorney General’s Office, and the state press. Now we’ll see whether they take transparency seriously, or if it’s just another marketing slogan.

Comments ()